Latest Videos

Now, financial intuitions can leverage the same reliable and customizable platform for purposes other than fraud notifications, through the same channels that the financial institution's customers are familiar with and trust.

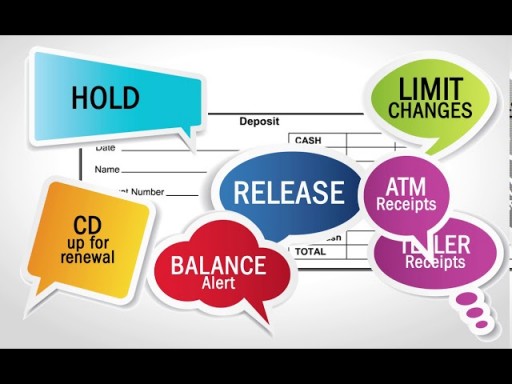

RediNotify allows a financial institution to communicate with customers in multiple use cases, such as deposit hold and release, overdraft limit changes, and much more.

Banks and Credit Unions can now streamline suspicious activity workflow and enhance efficiencies by out-sourcing fraud prevention to cardholders. RediVerify allows extensive options for each financial institution's preferences on customer contact. With RediVerify, financial institutions can decrease cardholder fraud and never lose the personal touch for cardholders.